ONLINE E TAX PAYMENT| STEP BY STEP PROCEDURE

PAYMENT OF 140A CHALLAN | ONLINE E-TAX PAYMENT TUTORIAL.

|

| ONLINE E TAX PAYMENT |

STEP 1:

BEFORE PROCESSING INTO THE ADVANCE E TAX PAYMENT FILLING. YOU MUST HAVE VALID INTERNET BANKING ON YOU BANK .

Have a Google search as Online E tax payment

HTTPS://tin-nsdl.com

|

| Online ETax payment Tutorial RADMI52 |

STEP 2:

FIRST , HAVE A GOOGLE SEARCH AS ONLINE e TAX PAYMENT

CLICK ON THE FIRST RESULT SHOWING

e-TAX PAYMENT - TIN WITH LINK HTTP://WWW.TIN-NSDL.COM>GUIDED

IT WILL TAKE YOU TO NEXT PAGE

Select IT Challan 280 in the webpage.

|

| Online ETax payment Tutorial RADMI52 |

IN THAT NEW PAGE CLICK ON THE FIRST DIALOGUE BOX WITH INCOME TAX & CORPORATION TAX (CHALLAN 280), WHICH IS SHOWN IN ABOVE IMAGE.

And in Next Page select

Fill the details In the Form and

And in Next Page select

Pay Taxes Online

|

| Online ETax payment Tutorial RADMI52 |

STEP 4:

IN THE FRESH PAGE ,LOOK FOR "PAY TAXES ONLINE", THAT IS MARKED ON THE IMAGE. MAKE SURE YOU ARE DOING AS PER PROCEDURE.

Fill the details In the Form and

* Are the Fields which are compulsory

|

| Online ETax payment Tutorial RADMI52 |

STEP 5:

IN THAT PAGE CLICK ON THE TAX APPLICABLE RADIO BOX OPTION.

CLICK ON (0020) CORPORATION TAX (COMPANIES) FOR COMPANY ASSESS.

CLICK ON (0021) INCOME TAX (OTHER THAN COMPANIES)FOR OTHER INDIVIDUAL, FIRM AND HUF.

MAKE SURE WHICH CATEGORY YOU FALL (WE ARE NOT RESPONSIBLE IF IT GONE WRONG OR MISDIRECTED).

SELECT What type of Tax You are paying mostly

|

| Online ETax payment Tutorial RADMI52 |

Mode payment is the type of payment you are choosing viz Net Banking, Debit card etc.

STEP 6:

IN FRESH PAGE, SELECT ON (100) ADVANCE TAX

IT IS MOSTLY USED FOR 100 & 300 (IT MOSTLY USED , IF YOU HAVE SPECIAL CASE, TAKE A CORRECT OPTION TO BE PICKED).

AFTER THAN, MAKE PAYMENT USE DIFFERENT METHOD.

|

| Online ETax payment Tutorial RADMI52 |

STEP 7:

THEY HAVE PROVIDED NET BANKING AND DEBIT CARD PAYMENT , CHOICE THE REQUIRED PAYMENT METHOD.

STAR MARK OPTION TO BE COMPLETELY FILLED

ESPECIALLY, WE HAVE TO FILL THE PAN NO THAT IS PERMANENT ACCOUNT NO:

FILL THE 10 DIGIT NUMBER

Select Assessment Year & Address of the Tax Payers

|

| Online ETax payment Tutorial RADMI52 |

STEP 8:

SELECT ON THE ASSESSMENT YEAR IN DROP DOWN BOX, FOR WHICH YOU HAVE TO SUBMIT YOUR ONLINE TAX PAYMENT.

FILL THE LOCALITY ADDRESS THAT IS IN PROOF WITH INCLUDE THE STREET NAME,CITY NAME, STATE NAME AND PINCODE OF YOUR LOCALITY.

FILL THE CAPTCHA IMAGE ON THE FOLLOWING DIALOGUE BEFORE PROCEEDING INTO NEXT STEP.

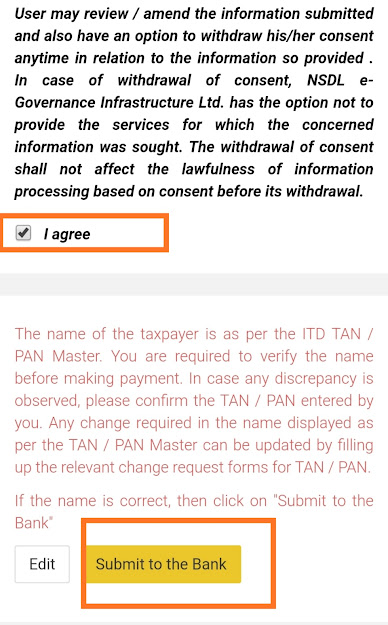

STEP 10:

Then the Webpage gives a Option to review your submitted Details check the details and if any wrong correct it and if there is no correction check the "AGREE" Check box and submit the form

|

| Online ETax payment Tutorial RADMI52 |

|

| Online ETax payment Tutorial RADMI52 |

|

| Online ETax payment Tutorial RADMI52 |

STEP 11:

After submitting the page will take you to the Bank Login , There fill your User ID & password.

|

| Online ETax payment Tutorial RADMI52 |

STEP 12:

MAKE PAYMENT THROUGH NET BANKING RETAIL FOR INDIVIDUAL AND USE CORPORATE FOR COMPANY USE.

LOG IN YOUR BANK ACCOUNT ENTER ID AND PWO

5 Comments

Very useful info.. keep going

ReplyDeleteUseful information 👍

ReplyDeleteUse full info

ReplyDeleteWell explained��

ReplyDeleteSuper ra... Helpful.. 👏👏

ReplyDelete